How AI Is Transforming Fraud Detection in Banking and Finance

Every second, billions of dollars move through digital pipelines across borders, banks, apps, and identities. Behind the glow of a smartphone screen or the click of a “Pay Now” button, invisible systems are working overtime to answer one crucial question: is this transaction real, or is it fraud?

Financial fraud today isn’t about forged checks or skimmed cards. It’s algorithmic, global, and constantly evolving. To keep up, banks and tech companies have turned to something faster than any human fraud team: artificial intelligence. These systems learn from vast datasets, detect hidden patterns, and flag anomalies in real time. They don’t sleep, don’t tire, and rarely miss what humans might overlook.

- The Frontline: AI detects complex, evolving, and global fraud patterns far faster than traditional rule based systems.

- Core Method: It uses behavioral analysis, flagging deviations from a user’s learned spending and login habits.

- Challenge: False positives (blocking legitimate transactions) damage customer trust and increase operational costs.

- Future: Predictive models are shifting protection from reactive blocking to real time risk scoring.

Algorithmic Defense: How AI Detects Fraud

At its core, AI fraud detection isn’t magic. It’s mathematics, scale, and relentless observation. Every time you tap your phone to pay, send a bank transfer, or check your balance, you generate a stream of behavioral data. It’s not just what you did. It’s when, where, how often, and how that compares to everything you’ve done before.

Unlike legacy systems that rely on static rules (like “flag anything over $10,000”), modern fraud detection looks for deviations. A $40 transaction at 2 a.m. in a country you’ve never visited could be more suspicious than a wire transfer worth thousands. These systems learn your patterns, then flag what falls outside them.

AI fraud systems can combine multiple learning types for robust security:

| Learning Type | Function | Goal |

|---|---|---|

| Supervised Learning | Trained on known fraud/non fraud data. | Catching familiar scams (e.g., card cloning). |

| Unsupervised Learning | Spots clustering/outliers in unlabeled data. | Detecting novel or zero day attack patterns. |

| Reinforcement Learning | Adapts based on real time analyst feedback. | Optimizing risk scores and minimizing false positives. |

This layered approach helps models stay effective even as fraud tactics evolve.

The Unintended Consequence: False Positives

But even the smartest system can get it wrong. For every genuine fraud it blocks, there’s a risk it flags something legitimate. A hotel check in during vacation. A late night impulse buy. A login from your new phone. When AI errs, the result is a locked account, a declined card, or a confused, frustrated customer.

False positives damage trust. For users, they feel like digital profiling. For banks, they’re costly: every alert demands human review, and too many false alarms risk customer churn. These aren’t just glitches. They’re consequences of the model’s assumptions and training data.

AI in finance often operates without explanation. Customers are denied access to their funds with no clear reason. Bank staff follow system prompts they can’t audit. Transparency is replaced by statistical confidence scores, and appeals processes are murky at best.

Troubling questions remain: Can a user appeal an algorithm? Who is accountable when a machine gets it wrong?

What to do now: Institutions must invest in Explainable AI (XAI) to provide human understandable justifications for high impact decisions.

Case Study and Systemic Failure

In 2020, Germany witnessed one of the biggest financial scandals in modern European history. Wirecard, once hailed as a fintech pioneer, collapsed when €1.9 billion in reported assets were revealed to be fictional. Investors were blindsided. Regulators embarrassed. And AI? Nowhere to be seen.

The Wirecard scandal exposed a fundamental truth about AI limits in finance:

- The Gap: Advanced AI only detects transaction fraud (bottom level), not organizational deception.

- The Discovery: It wasn’t an algorithm that uncovered Wirecard’s deception. It was investigative journalists and internal whistleblowers.

- The Lesson: AI can’t detect fraud it was never trained to see, especially when false data is deliberately embedded at the top management level.

This demonstrates that AI is a powerful tool for pattern detection but is not a substitute for human oversight, auditing, and corporate governance.

Some regulators are responding with new requirements for explainable AI, pushing institutions to open the black box and provide human understandable justifications. Others advocate for keeping a human in the loop, especially for high impact decisions. But building hybrid systems that balance speed with scrutiny is more than a technical problem. It’s a cultural and ethical one.

The Future: Predictive Risk Scoring

And the systems are only getting more powerful. The next generation of AI fraud detection isn’t just reactive. It’s predictive. Models now assign real time risk scores to users, devices, locations, and behaviors, often before a transaction is even attempted.

This means smarter protection against large scale attacks and identity theft. But it also means deeper surveillance. A user with limited credit history, or from a high risk postal code, might be treated as suspicious before doing anything wrong. The same tools that protect us could also quietly shape who gets trusted and who doesn’t.

For financial institutions, the future lies in striking a delicate balance: automation without alienation. Security without overreach. AI that protects, but doesn’t profile.

FAQ: AI and Financial Security

Q How does AI fraud detection differ from old rule based systems?

Old systems used fixed rules (e.g., flag transactions over $5,000). AI uses machine learning to analyze context, user behavior, and subtle deviations, adapting constantly to new threats.

Q What is a false positive in fraud detection?

A false positive occurs when the AI system incorrectly flags a legitimate transaction or activity as fraudulent, resulting in a declined payment or a locked account for the customer.

Q Can AI detect large scale corporate fraud like Wirecard?

Not easily. AI is excellent at detecting transactional and identity fraud. Corporate fraud involves deliberate deception and data manipulation at the top level, which the AI is usually not trained or positioned to detect.

In a Nutshell: Security vs. Scrutiny

AI has become the nerve center of modern fraud prevention. It analyzes patterns, blocks threats, and adapts in real time. But its power comes with risk: bias, opacity, and a growing gap between automation and accountability. As financial systems accelerate into the AI era, trust will depend not just on performance, but on fairness, transparency, and human centered design.

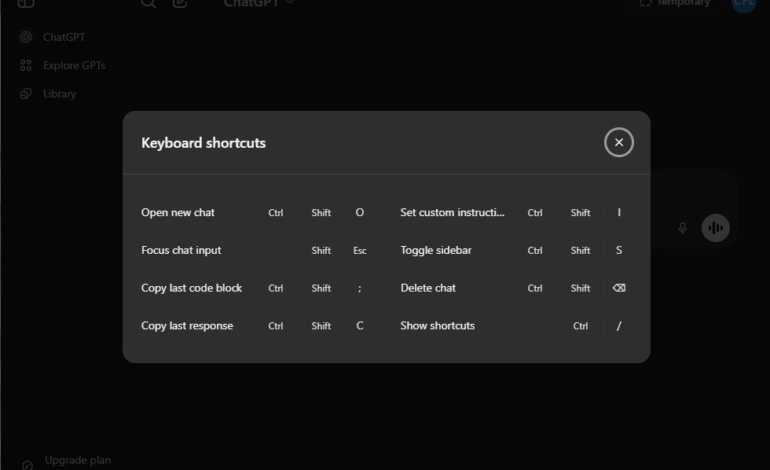

For more on ensuring fairness in these models, read our guide on Explainable AI (XAI). Also explore the underlying technology in our dedicated article: What is Machine Learning?